Donating highly appreciated stock allows you to avoid capital gains tax on it. It may also allow you to make a larger tax-deductible gift to Food First than you might otherwise be able to afford. To download sample language for stock donations, click here.

You or your broker must provide the following information:

- Donor’s name and complete address

- Name and number of securities transferred

Please contact Food First Interim Executive Director, LMichael Green, at the time of transfer:

Food First/Institute for Food and Development Policy 398 60th Street, Oakland, CA 94618 Email: lgreen@foodfirst.org Phone: 240-271-8685Electronic transfer of securities:

Food First’s brokerage is Empowered Investments. Call: (510) 622-0202, ext. 207 or 800-701-4713

The DTC# at NFS is 0226

Account Name: Institute for Food and Development Policy F/B/O: NFS A/C # Q81-002803 Food First’s Federal Tax ID number: 13-2838167Stock gifts are tax deductible for the full value of the stock on the day of sale, providing you have held them long enough to qualify. Consult the IRS or your accountant for requirements.

Food First can also receive your stock gift though a new account set up by your broker to receive and sell the stock. If your broker prefers to open an account for Food First, have them email LMichael Green at lgreen@foodfirst.org, or call at 240-271-8685.

Securities Delivered by Mail:

Electronic delivery of stock shares is more secure and faster than mail. If you prefer, you may transfer certificates by mail. Mail your unsigned stock certificate in one envelope and a stock power letter in a second envelope. If you have already signed your certificate on the back, send it to Food First by certified mail because a signed certificate is like cash. Mail to Food First/Institute for Food and Development Policy, 398 60th St., Oakland, CA 94618.

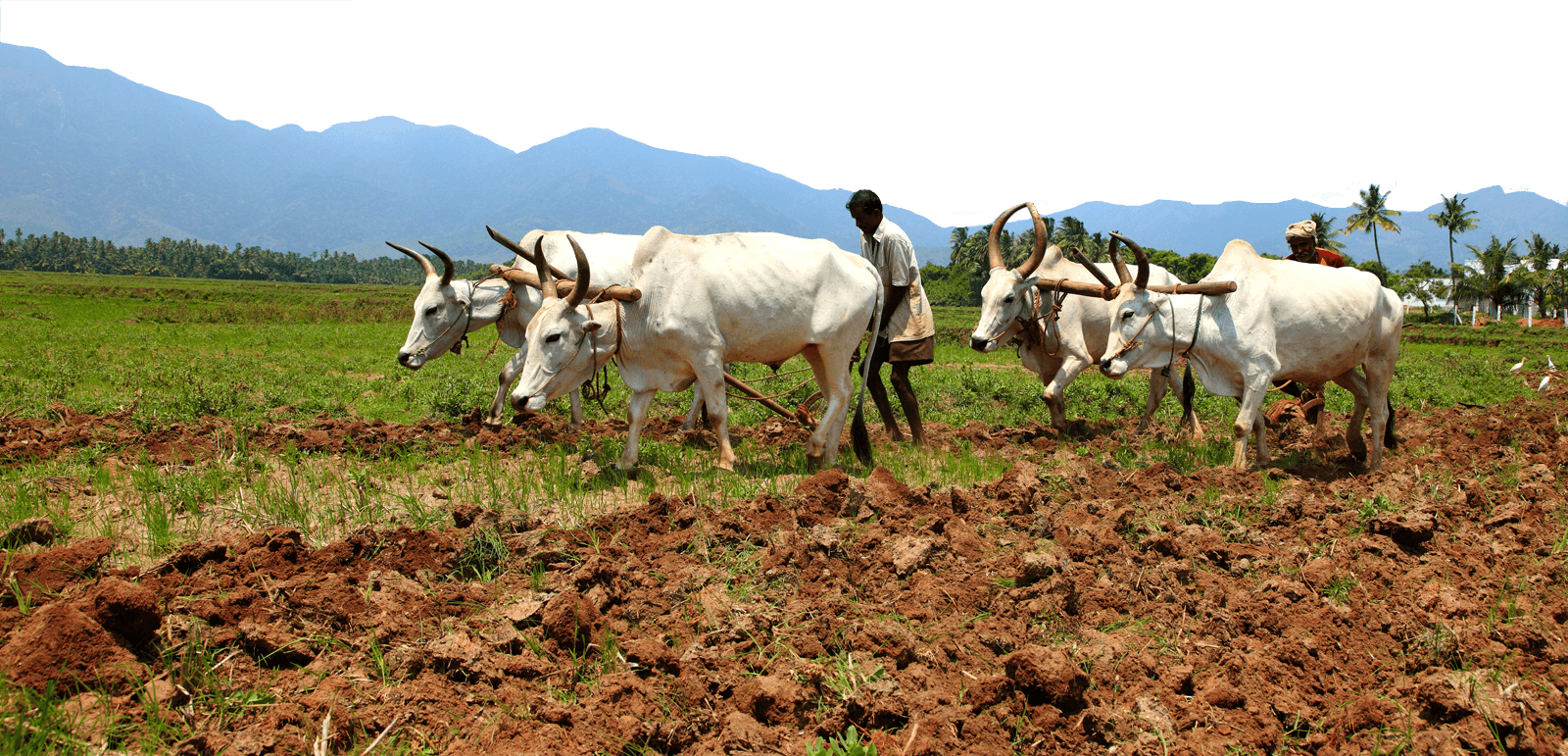

Help Food First to continue growing an informed, transformative, and flourishing food movement.

Help Food First to continue growing an informed, transformative, and flourishing food movement.